Talent Assessment

Claims Adjuster Personality Assessment

Hire and develop the best Claims Adjusters by utilizing our comprehensive assessment designed specifically for this role. Measure the essential character traits and soft competencies that are critical for success in Claims Adjuster positions.

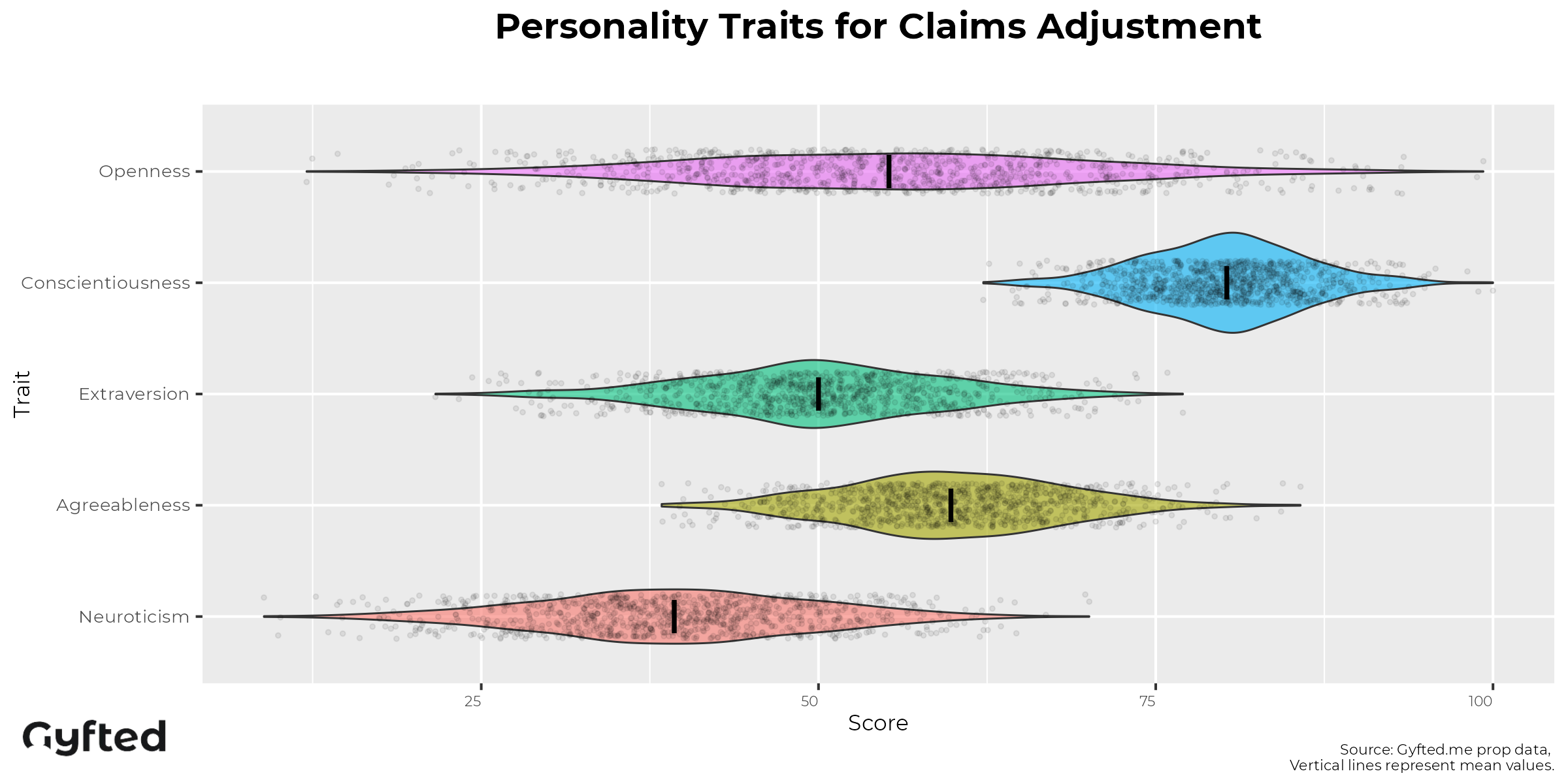

Claims Adjuster Persona traits

Conscientiousness is crucial as it drives attention to detail, ensuring accuracy in reviewing and processing claims while promoting strong time management skills. High levels of emotional stability (low neuroticism) are essential for maintaining resilience and composure under pressure, enabling adjusters to handle stressful situations effectively. Openness to experience aids in adaptability, allowing adjusters to adjust to new information and evolving industry standards seamlessly. Extraversion supports communication and negotiation skills, fostering effective interactions with clients, colleagues, and other stakeholders. Agreeableness, characterized by empathy and teamwork, helps in understanding clients' emotional needs and collaborating efficiently with team members to resolve claims comprehensively. These traits collectively foster a high-performing and adaptable claims adjustment team.

Used by growth companies and global brands

Hire and develop the best Claims Adjusters

Measure claims adjuster traits

In the role of a Claims Adjuster, certain Big Five personality traits significantly enhance performance and success.

Better than the Indeed Claims Assessment

Hire and develop the best Claims Adjusters by leveraging Gyfted's talent assessment platform, which offers unparalleled insights into the essential character traits and soft competencies that define success in this role. Our platform not only streamlines the hiring process by identifying candidates with the optimal blend of skills and attributes but also provides actionable data to foster ongoing talent development. By focusing on potential and role fit, Gyfted ensures that you build a high-performing team characterized by precision, empathy, and resilience—crucial qualities for excelling in Claims Adjuster positions.

Measured Claims Adjuster personality traits

Skeptical vs Trusting: Claims Adjusters who lean towards skepticism are better equipped to thoroughly investigate claims, ensuring that all details are accurate and preventing potential fraud. Trusting individuals, although valuable for building rapport with clients, may benefit from a balanced approach to verify information without compromising the integrity of the claims process.

Composed vs Reactive: Composed adjusters maintain calm and control under pressure, essential for handling the high-stress environment of claims adjustment. They can manage difficult conversations with clients and stakeholders effectively, ensuring that decisions are made logically rather than emotionally, which promotes better outcomes.

Pragmatic vs Curious: Pragmatic adjusters focus on practical solutions and efficiency, which is critical for processing claims promptly and accurately. Curiosity, while bringing innovation and adaptability, must be balanced with pragmatism to ensure that curiosity-driven approaches do not delay the resolution of claims.

Orderly vs Adaptable: Orderly adjusters excel in maintaining structured processes and organization, crucial for managing multiple claims and meeting deadlines. Adaptable adjusters, on the other hand, can easily respond to new information and changing industry standards, making them versatile in dynamic scenarios.

Dutiful vs Flexible: Dutiful adjusters are committed to their responsibilities and uphold high standards of accuracy and thoroughness in claims processing. Flexibility is also important as it allows adjusters to navigate unforeseen challenges and adjust their approach when necessary, ensuring effective claims resolution.

Reflective vs Confident: Reflective adjusters carefully consider all aspects of a claim before making decisions, which minimizes errors and enhances thoroughness. Confident adjusters, with their decisive nature, can lead processes efficiently and instill trust in clients and colleagues, though they must ensure their confidence is well-founded on factual information.

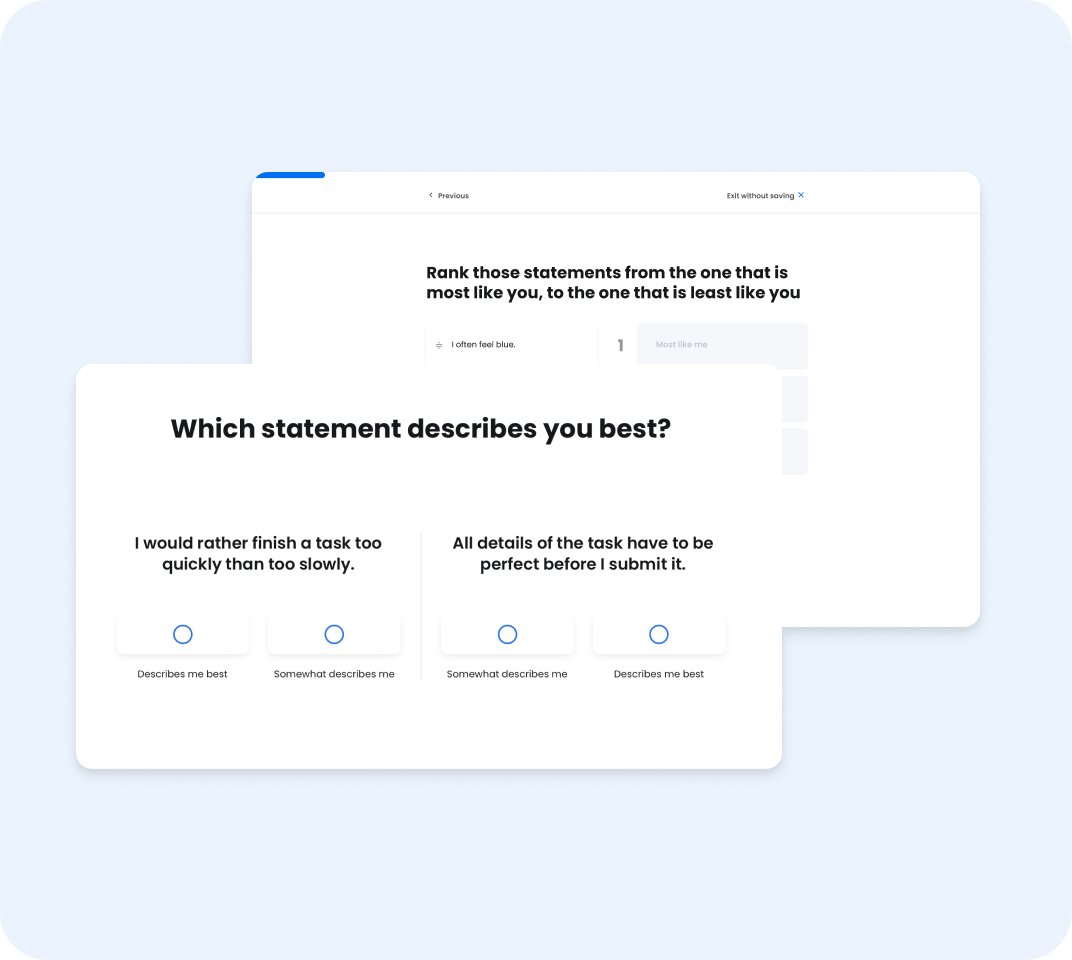

Talent screening

Talent screening must involve personality screening. This is because personality determines our preferences and behaviors. Research shows that people self-select over time into certain occupations depending on their personality, and certain personalities “fit” certain types of roles better. This matters for startups and large organizations alike.

Cognitive ability measures

We test for cognitive ability and/or basic data analytics ability in order to help you get motivated, high potential applicants.

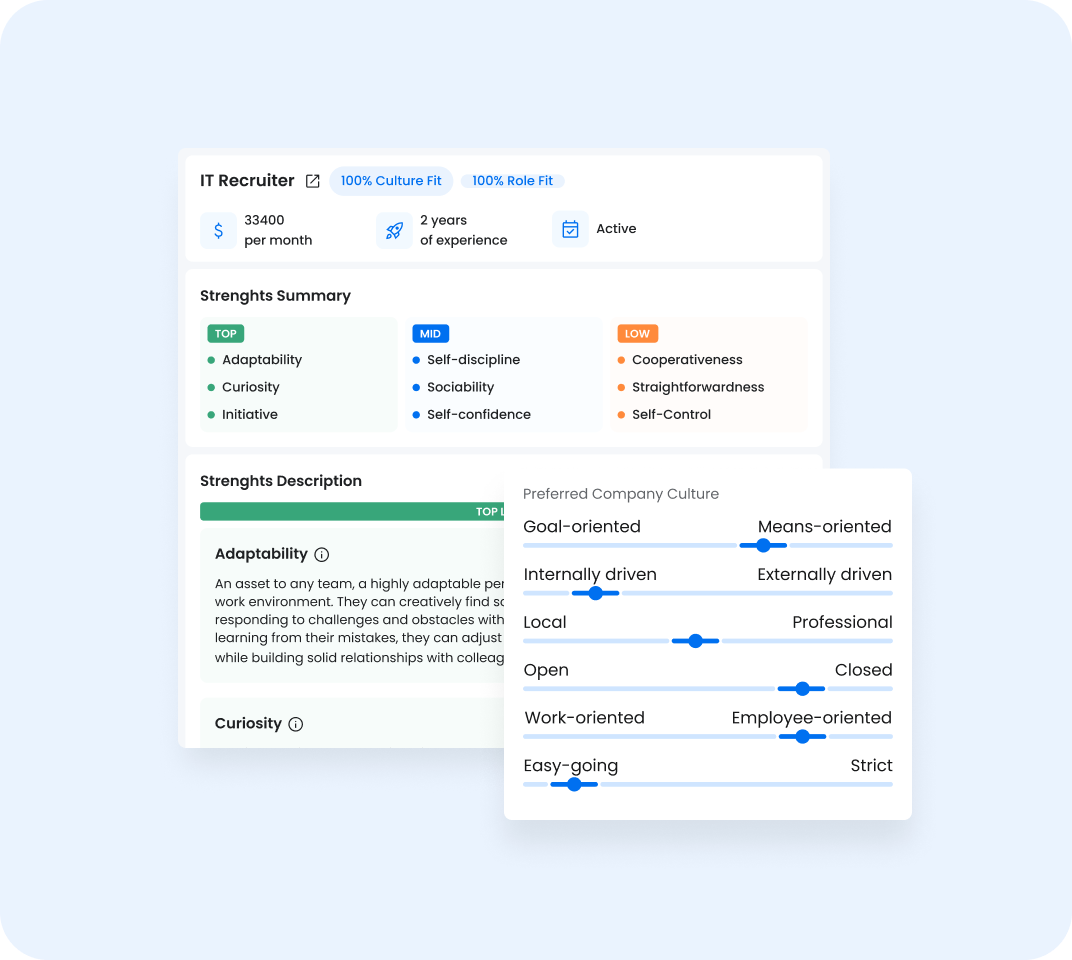

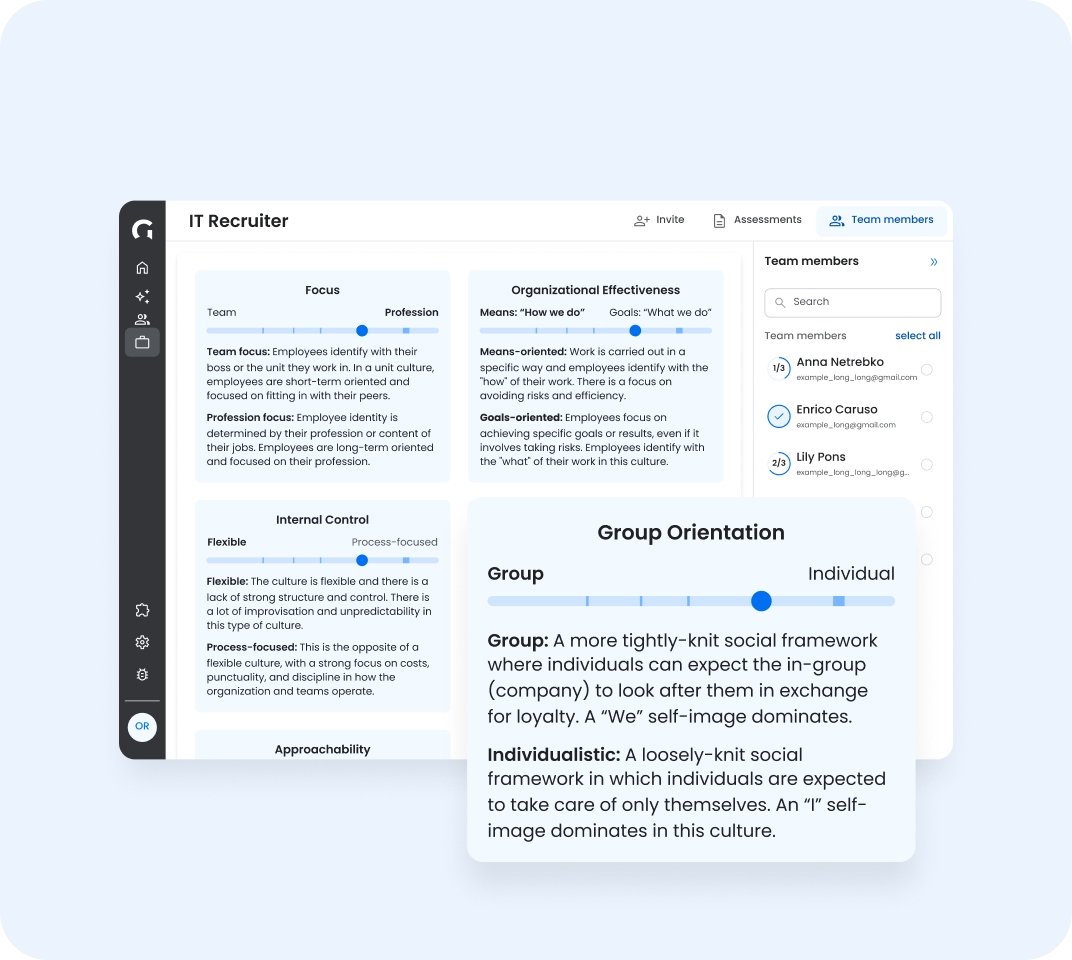

Culture fit assessments

Candidate culture fit assessments based on shared values and preferences can help you figure out who could be a great fit for your team and organization. You can easily evaluate job candidates to identify who to hire more easily using Gyfted.

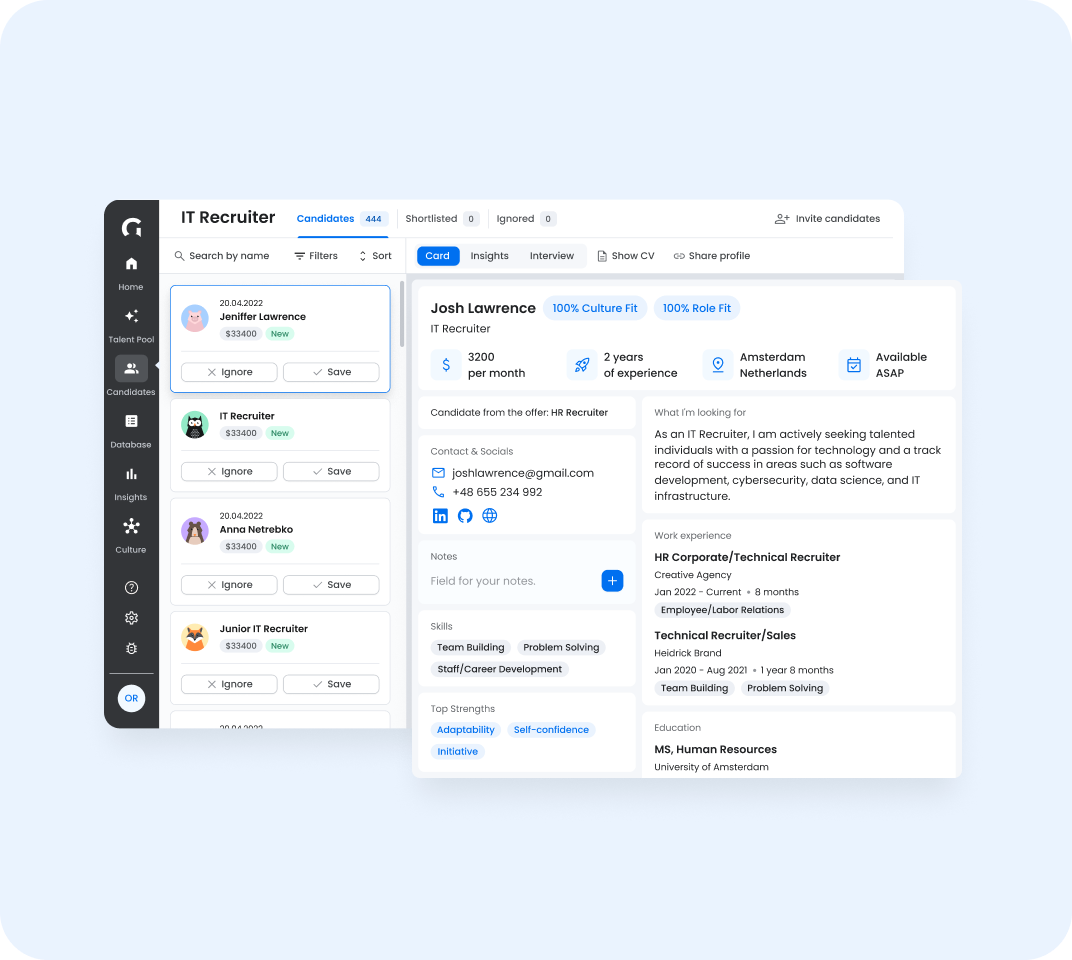

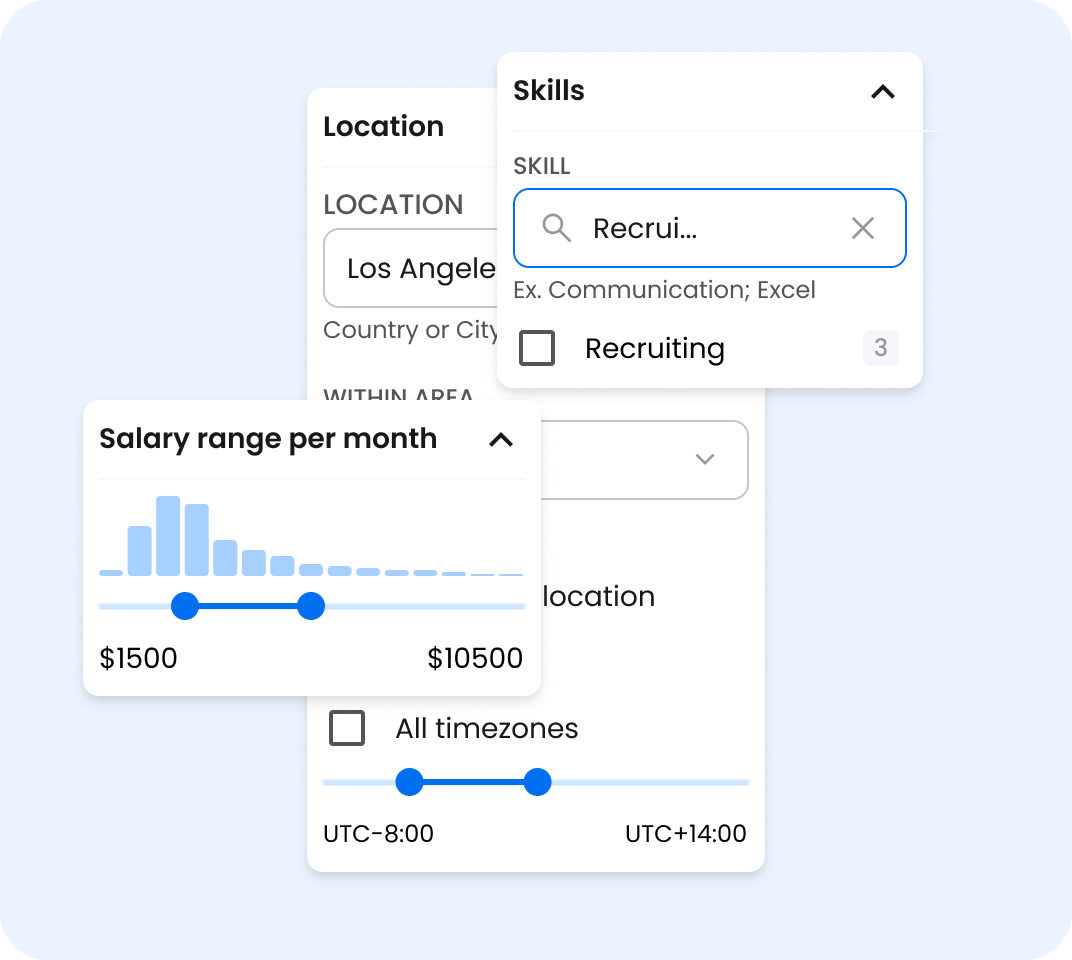

Powerful applicants filters

Filter your applicants by skills, past industries, salary, location. Sort applicants by culture fit specific to your needs, overall fit relevant to the role and to your needs.

Objective candidate ranking and selection

Assess candidates anywhere in your hiring funnel. We enable you to see a stacked-ranking of candidates powered by powerful filters and search. Our system learns your preferences when you create your role and when you select applicants, so you can make better hiring decisions.

Team culture measures

Measure your team culture to get insights into who to hire from a culture fit and culture add point of view. Because we all perform differently in various environments, hiring skills first can fail. The organizational culture you’re hiring for culture fit and diversity at the same time, in order to drive performance, as well as well-being.

Claims Adjuster competencies

- attention to detail: ensuring accuracy in reviewing and processing claims to avoid errors and oversights.

- analytical thinking: ability to assess complex information and data to make informed decisions regarding claims.

- communication skills: effectively conveying information and discussing claims with clients, colleagues, and other stakeholders.

- problem-solving: identifying issues and developing solutions to resolve claims promptly and efficiently.

- empathy: understanding and addressing the emotional needs of clients during stressful situations.

- negotiation skills: reaching fair settlements with claimants, policyholders, and other parties involved.

- time management: prioritizing tasks and managing workload to meet deadlines and handle multiple claims simultaneously.

- adaptability: adjusting to new information, changing circumstances, and evolving industry standards.

- resilience: maintaining composure and perseverance in challenging situations and high-pressure environments.

- teamwork: collaborating effectively with colleagues and other departments to ensure comprehensive and accurate claims handling.

How to hire a Claims Adjuster

To hire a Claims Adjuster effectively, start by clearly defining the key traits and competencies necessary for success in this role. Utilize Gyfted's Claims Adjuster Personality Assessment to screen candidates based on essential characteristics such as attention to detail, analytical thinking, and empathy. This assessment measures traits like Skeptical vs Trusting, Composed vs Reactive, Pragmatic vs Curious, Orderly vs Adaptable, Dutiful vs Flexible, and Reflective vs Confident. By incorporating these metrics, you can ensure that the candidates not only possess the requisite skills but also align with your organization's values and work environment.

Enhance the hiring process by integrating further assessments to evaluate team culture fit and remote work compatibility. These additional evaluations will help you identify candidates who can thrive in a collaborative setting and adapt seamlessly to remote work dynamics, which is particularly important in today’s flexible work landscape. By focusing on both personality traits and practical skills, Gyfted's platform provides a comprehensive approach to selecting and developing top-tier Claims Adjusters, ensuring your team is equipped with individuals who excel in precision, empathy, and resilience.

Our assessments are designed by top scientists

Our tools are developed by psychologists, psychometricians and cognitive scientists

with research experience from institutions like these:

with research experience from institutions like these:

Claims Adjuster Assessment

Frequently asked questions

How can I use Gyfted's Claims Adjuster Personality Test to screen candidates?

Gyfted's Claims Adjuster Personality Test offers a strategic approach to screening candidates by focusing on the essential traits and competencies required for the role. By leveraging metrics such as Skeptical vs Trusting, Composed vs Reactive, Pragmatic vs Curious, Orderly vs Adaptable, Dutiful vs Flexible, and Reflective vs Confident, the assessment ensures that potential hires have the precise qualities necessary to excel in claims adjustment. This includes a strong attention to detail, analytical thinking, and empathy. Such a comprehensive evaluation allows you to identify candidates who are not only skilled but also align with your organization's values and work culture, ensuring that they can handle the intricate and often stressful demands of the job effectively.

Additionally, Gyfted's platform enhances the hiring process by integrating further assessments to evaluate team culture fit and remote work compatibility. This holistic approach is particularly relevant in today's flexible work environment, where the ability to thrive in remote settings and collaborate effectively with team members is crucial. By combining personality trait assessments with practical skills evaluations, Gyfted provides actionable insights that streamline the hiring process and support ongoing talent development. This ensures that your team is composed of Claims Adjusters who demonstrate precision, empathy, and resilience, key qualities that contribute to their success and the overall efficiency and integrity of your claims processing operations.

How much does the Claims Adjuster Assessment cost?

At Gyfted, we do not charge specifically for the Claims Adjuster Assessment. Instead, we provide a comprehensive assessment and screening infrastructure for recruiters and talent managers. Our pricing model is subscription-based and tailored to your specific needs, granting you access to our software and a range of assessments, including the Claims Adjuster Assessment. For detailed pricing information, please visit our pricing page at [Gyfted Business Pricing](https://www.gyfted.me/business/pricing).